- USDT(TRC-20)

- $1,545.9

BlackRock, the world’s largest asset manager, is mulling over expanding its Bitcoin investment portfolios, foreseeing a substantial uptake potential for the cryptocurrency.

Speaking recently to The Wall Street Journal, Rick Rieder, BlackRock’s Chief Investment Officer of global fixed income, acknowledged the firm’s modest exposure to Bitcoin. He further noted that as investor confidence in Bitcoin grows, BlackRock may consider allocating Bitcoin a more prominent role within its investment portfolios.

“Time will tell whether it’s going to be a big part of the asset allocation framework,” Rieder said, adding, “I think over time, people become more and more comfortable with it.”

Rieder further emphasized the importance of providing investors with accessible avenues to engage with Bitcoin, whether it be through ownership, trading, or liquidation. He also stressed that as more individual and institutional investors embrace Bitcoin as a legitimate asset, its potential for significant growth will become increasingly evident.

“As you get more and more people that adopt it as an asset, we think the upside potential is real.” He added.

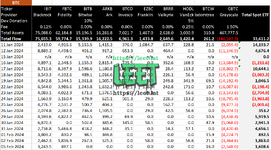

That said, BlackRock’s contemplation of bolstering its Bitcoin holdings coincides with a broader trend of rising interest in cryptocurrency investment vehicles. Notably, BlackRock has already taken proactive steps in this direction after launching a spot Bitcoin ETF Fund that currently manages over $3 billion worth of the digital currency. Since the bitcoin exchange-traded funds (ETFs) were approved last month, BlackRock and Fidelity have surged into the top ten largest US ETFs by asset inflows, collectively attracting $6.39 billion in Bitcoin.

Meanwhile, Grayscale Bitcoin Trust ETF (GBTC) has continued to experience large outflows, totalling just over $6.8 billion since the spot ETF approvals.

It shall be recalled that Bitcoin experienced a significant rally in late December, fueled by speculation surrounding the potential approval of a spot ETF from BlackRock. Larry Fink, the CEO of BlackRock, attributed this surge to a discernible shift in investor behavior stating, “I believe the surge is linked to investors seeking refuge in ‘quality’ assets amid the ongoing Israeli conflict and global terrorism concerns.”

Moreover, Fink expressed optimism regarding the expanding adoption of Bitcoin, emphasizing that BlackRock’s foray into the cryptocurrency market aligns with the company’s mission to provide straightforward and accessible investment options for clients.

“We believe we have a responsibility to democratize investing. We’ve undertaken significant efforts, and the global role ETF plays in transforming investments is just the beginning.” Fink stated.